73 Money Saving Techniques That Will Transform Your Year!

Do you want to know more about money saving techniques that will transform your year?

Budgeting and savings don’t have to be complicated; you just need the right strategies and a bit of consistency to stay on track.

That’s why I’ve compiled for you this list of simple and realistic money-saving techniques that will transform your year.

Even when life gets too busy and chaotic, these savings tips will grow your confidence and savings, one step at a time.

It’s because of my consistency and little efforts to save money that I got to buy my dream house for my family. I know that my daughter will get the education she wants, that we can travel around the world, and most importantly, we are financially safe if anything were to happen!

That’s the dream: stress-free life!

Here is a pic of my beautiful renovated kitchen!

Best Money Saving Techniques for Budgeting

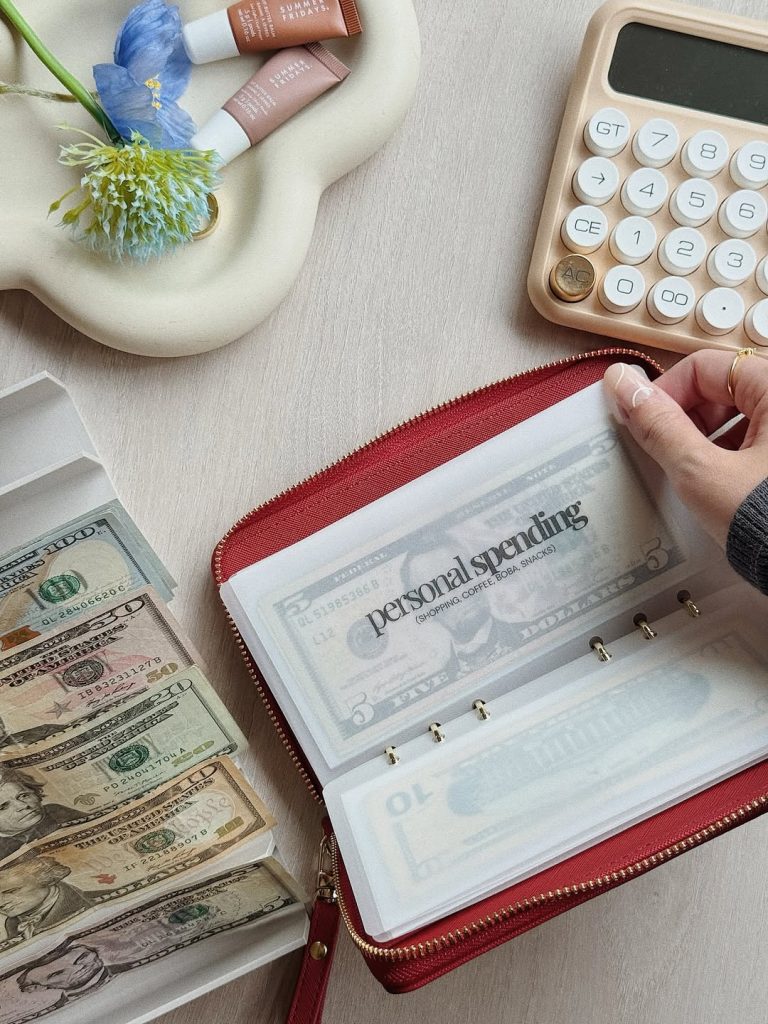

1.Cash Envelope Method – Money Saving Techniques That Will Transform Your Year

In each envelope, you put the exact amount of money you have allocated to each spending category (physically with cash or electronically with an app or spreadsheet).

Once there’s no more money in one of the envelopes, you cannot spend any more money towards that budget category.

If you have remaining funds, you can either keep them for the next month, put them in your savings, or in another budget category.

@trangsplans

2.50/30/20 Budget Method

This budgeting method allocates your income into 3 main categories:

- 50% of your income goes to your needs (all your monthly bills and essential groceries)

- 30% goes to your wants (travel, hobbies, you name it)

- 20% goes to your savings.

With this method, you need to be honest with yourself about your needs and wants.

@the_financial_og

3.Pay Yourself First Budget

These are the keys to our MORTGAGE-FREE HOUSE we bought with my husband this year! So keep your goal in mind! Your hard work will pay off.

This method is based on transferring your money to your savings account on your payday so that you are prioritizing your savings.

You can automate it on the same day as you receive your income. Honestly, I like to pay all my essentials first, so that I don’t have to worry about the rest.

Because money you don’t see can’t be spent, right?

4.Zero-Based Budgeting Method

In the zero-based budget, every single dollar of your income is assigned to a specific expense, and once you’ve paid all your bills and put money aside for your savings and funds, your balance is $0.

This is an extreme method to make sure you don’t have any impulsive purchases.

5.Create Sinking Funds For Irregular Expenses

Set aside small amounts each month for predictable but irregular costs, like birthdays or holidays. This prevents surprise bills from blowing up your budget.

Christmas, birthdays, Mother’s Day, there’s always a reason to spend money on your loved ones, but if not planned, this can drain your budget. Allocate cash on the side, so that when you have to go present shopping, you can spend without guilt and still keep your budget on track.

6.Pay Off Your Debt Before Saving

High-interest debt eats into your income faster than savings can grow. Clear it first so future savings actually work for you.

Imagine you have a €1,000 balance on a credit card charging 20% interest. If you only make minimum payments, that debt keeps growing, costing you extra money every month.

At the same time, you put €1,000 into a savings account earning 2% interest.

Even though you’re “saving,” the 20% interest on your debt is increasing faster than the 2% interest on your savings. In the end, your savings barely grow — but your debt gets bigger.

That’s why clearing high-interest debt first helps your money actually work for you, not against you.

7.Start A Rainy Day Fund

Build a small emergency cushion for unexpected expenses like a broken appliance or vet bill. Even $300–$500 can stop you from relying on credit. This is pretty much like the sinking funds technique for unplanned expenses.

Last month I had to pay $200 bill to fix my car. It’s thanks to the money I put aside in my rainy day fund that I could pay the bill; otherwise, my budget didn’t cater for an extra $200 this month.

8.See a Financial Adviser – Money Saving Techniques That Will Transform Your Year

If you feel overwhelmed or stressed out by budgeting and money-saving techniques, don’t be ashamed to ask for help.

A professional can help you understand your money, goals, and long-term financial plan. Of course, this shouldn’t put you in a bad place, money-wise.

- Get free debt advice from these approved agencies in the UK.

- Get free debt advice from these approved agencies in the USA.

9.Keep a Loose Change Jar

A jar, a piggy bank, a wallet, you name it. But just get a spot to put your spare change every day, and you’ll see how fast it can add up.

10.No Access Saving Accounts

If you don’t need to use your savings anytime soon, getting a no-access savings account might be the best way to make sure you don’t touch it and let it grow.

If you can’t withdraw it you won’t spend it.

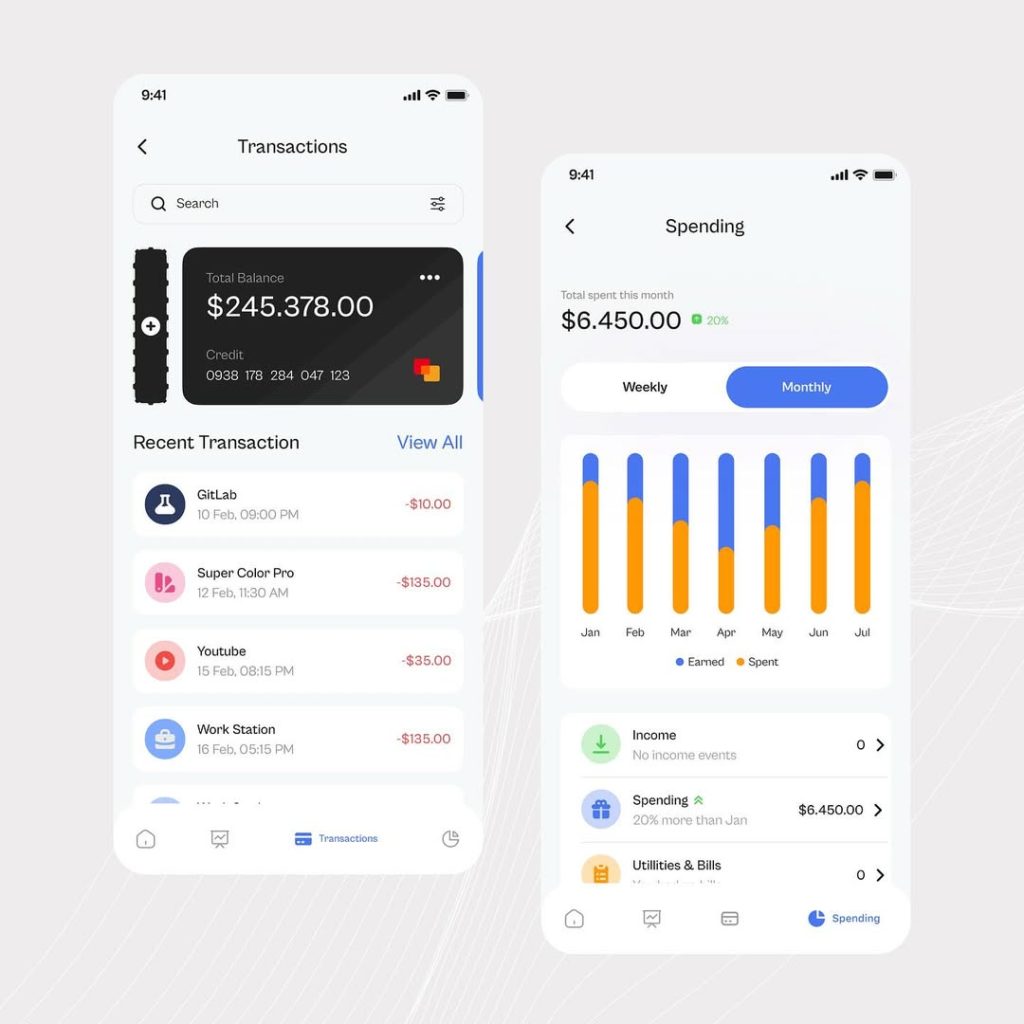

11.Track your spending daily

At the beginning, you might need to track your spending daily. Yes, get a little obsessed with it. It’s the perfect way to build a mindset and to prevent you from overspending.

12.Set Weekly Spending Limits

Shorter time frames are easier to monitor, so break down your budget into weekly goals.

13.Review and Adjust Your Budget

Budgets are not static; they evolve along with your life, expenses, and income changes.

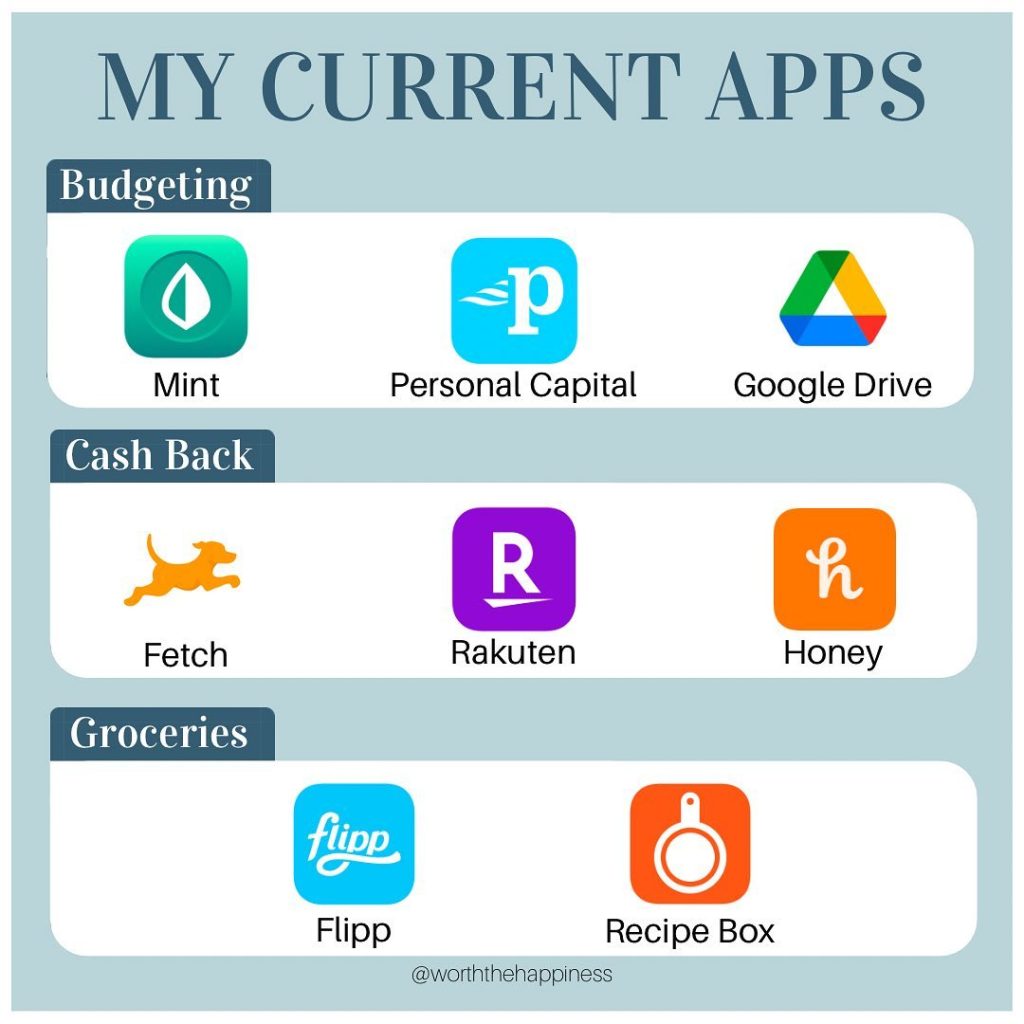

14.Use Round-Up Saving Apps

Here is an effortless way to grow your savings quietly: these apps round up your purchases to the nearest dollar and put the difference aside automatically.

@worththehappiness

15.Automate Bill Payments – Money Saving Techniques That Will Transform Your Year

Automating your bills is one of the simplest ways to stay on top of your finances.

No more late fees, no surprises, and no “oops, I forgot!” moments. It keeps your budget running smoothly with zero effort from you.

You can either schedule automatic payments with your bank (from your app or ask your counselor to do it for you) or directly through the vendor’s website.

16.Check Your Budget Before Any Non-Essential Expense

Before you hit that “check out” button, take a quick peek at your budget. If it doesn’t fit, it waits—that’s the rule. This will save you from spending money you might not have!

Ps; if you are going into debt to buy it, then its a big NO

@olabode_uiux_designer

17.Review Your Bank Statements Line By Line

Grab a cup of tea and go through your statements slowly—yes, every line.

You’ll be shocked at the forgotten subscriptions, duplicate charges, and tiny leaks hiding in there. Spot them early, and you instantly save money.

Bank statements are issued monthly by your bank and include all your financial transactions, such as withdrawals, deposits, interest, and automatic payments.

This way you can easily see how much money is going in and how much is going out.

It’s also a great way to discover if you’re a victim of credit card fraud: tiny purchases you haven’t made and cost you money monthly!

18.Use Visual Trackers

Sometimes you just need to see your progress to stay motivated. Colouring charts, progress bars, or savings thermometers make saving feel fun and satisfying.

@lisagrahamrealtor

Best Money Saving Techniques for Groceries

19.Shop for groceries at cheaper supermarkets

Most of the time, when comparing one supermarket to another, some items are almost double the price!

So before your next grocery outing, compare prices from the supermarkets around you and see which one is the most affordable!

20.Shop at Online Supermarkets – Money Saving Techniques That Will Transform Your Year

One thing I like to do is to shop online at the drive-through supermarket, it’s easier to:

- compare the prices on the app and get the cheapest deals(not having to break my neck in the aisle looking for the price/Kg)

- get a clear idea of the promotional deals

- stick to the grocery list

Bonus: your groceries go straight to your car’s trunk!

21.Use loyalty cards

If you’re already shopping somewhere regularly, you might as well earn points for it. Loyalty cards can give you discounts, freebies, or cashback on things you buy anyway. It’s one of the easiest “set it and forget it” ways to save.

22.Cashback apps and credit cards

Cashback apps and cards basically pay you for spending smart. Just make sure you’re buying what you need, not extra things just to earn cash back. Used wisely, they give you tiny savings that quietly add up.

23.Buy in Bulk

Buying in bulk is perfect for the staples you use all the time: pasta, rice, canned beans, coffee, toilet paper…

24.Use Coupons and vouchers

Coupons and vouchers are such a great deal! Especially for expensive items such as baby wipes and diapers.

25.Generic Brands – Money Saving Techniques That Will Transform Your Year

Store-brand products often taste the same, work the same, and cost a lot less. Start by swapping out a few items and see what you don’t even notice. Most of the time, the only difference is the price tag.

For example, some of the core ingredients, such as flour, sugar, and milk, don’t vary in composition from one brand to another.

Just like baby formula! You might think this one shouldn’t be cut back on, but this is a product that has to meet safety standards and nutrition guidelines, so store brands are pretty much the same as the expensive brand ones!

26.Buy Whole Instead of Cuts

Whole chickens and whole fish cost significantly less than pre-cut. You can also get better prices at the butcher and fresh sections in supermarkets! Plus, they often clean it for you.

27.Get Beans Instead of Meat Once in a While

Beans are cheap, filling, and full of protein—your budget and your body will thank you. Swap them in once or twice a week and watch your grocery bill shrink.

You can still enjoy meat, just a little less often.

28.Bring your own bags

Reusable bags save you money every single time you shop (those bag fees add up!). They’re sturdier, more eco-friendly, and stop you from hoarding plastic at home. Keep a few in your car or by the door so you never forget.

29.Look for The Discounts

Before you grab anything, check the discount shelves or the yellow stickers.

These items are usually perfectly fine and massively reduced. Build a few meals around discounted finds, and your total bill drops like magic.

30.Write a Shopping List (& stick to it!)

A simple list keeps you focused and stops random items from sneaking into your cart. It also helps you avoid duplicates and unnecessary extras. The real trick? Actually sticking to it—no “just in case” items allowed!

Here, it’s me cycling because it’s FREE and it keeps me healthy. A debt-free life is worth more than fancy hobbies.

Best Money Saving Techniques For Bills and Subscriptions

31.Internet and Phone Bills

Call your internet/phone provider once a year to renegotiate your subscription deal. They almost always offer a discount when you ask.

32.Energy Bills – Money Saving Techniques That Will Transform Your Year

Consider switching to a cheaper energy provider if available. Comparing rates once a year can save hundreds.

33.Turn your thermostat down by 1–2 degrees

Small change, big savings on heating. Of course, be reasonable with it, but wearing layers at home is totally fine if it means saving a few hundred.

34.Use programmable thermostats

Consider investing in smart and programmable thermostats that switch on only when you’re home.

Here is the best smart and programmable thermostat to shop online.

35.Unplug electronics when not in use

Standby power quietly adds to your bill. When going out, it’s always a good habit to unplug devices that are consuming unnecessarily.

The same applies when going on holiday, think of unplugging your internet box, which consumes a lot of energy (and money)!

36.Run the washing machine and dishwasher only when full

Cuts electricity, water, and detergent costs.

37.Wash clothes in cold water

Works for 90% of laundry and saves a lot of energy.

38.Air-dry clothes whenever possible

Dryers are one of the most expensive appliances to run, so air-dry clothes whenever possible, especially during the summer months.

39.Switch to Energy Saving Appliances

They last longer and use far less electricity. You can switch to energy-saving light bulbs and LEDs.

40.Take shorter showers

Even reducing by 2 minutes saves water and heating costs.

41.Check for water leaks

A dripping tap can waste hundreds of litres per month. And I speak from experience, I once had to pay an extra $200 for a sneaky leak behind a sink.

The best way to know if you have a water leak somewhere is to check your water consumption and see if it goes off the chart at some point; even the smallest leak will show up, trust me.

Some insurance policies cover these accidents, so if it ever happens to you, be proactive and check with your insurance provider because they’re not gonna hand you money if you don’t ask!

42.Bundle services (internet + mobile + TV)

Only if the bundle is truly cheaper than separate plans and doesn’t make you pay for something you don’t need.

43.Downgrade memberships or cancel entirely

Whether it’s a gym or cinema membership, a learning platform, consider downgrading or even canceling it entirely.

There are plenty of free resources for you to learn and upskill, such as free YouTube workouts or outdoor exercises.

44.Use smart plugs or timers

These ensure appliances aren’t running longer than needed. You can shop for these smart plugs or plug timers.

45.Review your insurance policies yearly

Compare quotes — loyalty usually costs you more.

46.Switch to prepaid mobile plans

You typically pay less and avoid surprise fees.

47.Pay bills on time with automated payments

No more late fees, no more stress. This will make you financially reliable, trust me, it’s a great feeling.

48.Ask for a discount when paying bills annually

Some services offer 5–10% off for yearly payments. Consider it for car or home insurance, any membership you need to keep.

Best Money Saving Techniques For Shopping

49.Share Subscriptions

Why pay full price when you can split it? Sharing streaming or app subscriptions with family or friends cuts your monthly costs instantly. Same access, half the price.

50.Buy Second Hand

Thrift stores, Facebook Marketplace, and vintage shops are goldmines. For me, it’s a great way to be able to afford high-quality products for a fraction of the cost. Plus, it’s eco-friendly and fun.

51.Repair before Rebuying

A loose button or a wobbly chair doesn’t always mean “buy new.” A quick fix can save you a lot of money over time. Repair first, replace only if you really have to. Plus, it’s gratifying.

52.The 72h Rule

Before buying something non-essential, wait 72 hours. If you still want it after three days, fine—but most of the time, the urge will vanish.

53.No-spend Week – Money Saving Techniques That Will Transform Your Year

Challenge yourself to a whole week of spending nothing outside essentials. It’s a reset for your habits, your wallet, and your mindset. You’ll be surprised how refreshing it feels.

54.Set a fixed monthly personal spending allowance.

Give yourself a clear limit for fun money each month. It keeps you in control without feeling deprived. When the allowance is gone, you pause—simple.

55.Use cash when possible.

Cash forces you to stay aware of what you’re spending. When you physically hand over money, it hits different. It’s the easiest way to avoid blowing your budget.

56.Unsubscribe from marketing emails.

Your inbox shouldn’t be a temptation trap. Clearing out brand emails means fewer sales, fewer “just browsing” moments, and way fewer impulse buys.

57.Unfollow spend-triggering influencers.

If someone’s posts make you want to buy things you don’t need, hit unfollow. Protect your peace—and your bank account. The last thing you need is daily reminders to shop.

58.Avoid browsing shops for fun.

Shopping is not a hobby! Wandering around stores leads to “accidental” purchases almost every time.

59.Borrow items before buying.

Need a drill, an outfit, or a cake tin? Borrow it instead of buying something you’ll barely use. Your friends probably have what you need—and you can return the favour.

If no one can lend what you’re looking for, consider second-hand options.

60.Set a small monthly treat budget

Treats are important, but boundaries are too. Give yourself a small, guilt-free amount each month so you don’t swing into overspending. It keeps everything balanced.

61.Carry snacks and water.

Half of impulse spending happens because we’re hungry or thirsty. Keeping snacks and a water bottle on hand saves you from that $14 latté. Simple, but powerful.

62.Do a monthly declutter.

Decluttering reminds you how much you already own (and how much you don’t need). It reduces the urge to buy duplicates or “just something new.” Plus, you might even find items to sell.

63.Track all small purchases.

Little expenses add up the fastest—coffees, snacks, apps, all of it. Tracking them keeps you aware and stops sneaky budget leaks. A two-minute habit that changes everything.

64.Look For Free Activities

Fun doesn’t have to cost money. Explore local parks, free museums, community events, or at-home activities that make you feel good without spending a cent. Free fun is still fun — and your wallet stays happy.

65.Set a monthly spending goal.

Don’t try to do it all at once; this increases your risk of failing. Give yourself one clear challenge each month, like cutting food costs or reducing takeout. Focus beats overwhelm every time. Small monthly wins = big progress.

66.Use an accountability buddy.

Share your goals with a friend and check in regularly. It keeps you motivated, honest, and far less likely to overspend.

67.Choose low-cost hobbies.

You don’t need expensive hobbies to have fun. Walking, baking, reading, drawing—there are so many budget-friendly options. Your bank account will love you for it.

68.Cut down on smoking and drinking

These habits drain your wallet faster than you realise. Even reducing them a little saves a surprising amount each month. Plus, your health wins too.

Best Money-Saving Techniques for Household Expenses

69.Switch to LED bulbs.

LED bulbs use far less energy and last way longer than traditional ones. It’s one of those tiny swaps that saves you money quietly in the background.

Here you can shop for the best LED Bulbs.

70.Buy cleaning products in bulk.

Buying in bulk means you pay less per use and restock less often. It’s a simple shift that saves money on items you need all year long.

71.Cook at home more often.

There’s nothing like eating out a bit too often that drains your wallet. Eating at home is one of the fastest ways to cut spending. With a bit of planning, you can make delicious meals for a fraction of restaurant prices.

72.Manage your temperature.

Learning how to regulate your temperature effectively is the perfect trick to keep your household expenses low.

During the hot season, open the windows when it’s cool and keep them closed once the sun comes out.

During winter, pull the curtains and close the blinds at night to keep the warmth inside.

73.Shop second-hand for home items.

Just like for clothes, you can shop for tableware, furniture, and decorations for almost nothing at thrift shops, yard sales, and on Facebook Marketplace.

Final Thoughts: Small Changes, Big Savings

Saving money doesn’t have to feel restrictive — it’s really about making small, intentional choices that support the life you want.

Every tip on this list is simple enough to start today, and powerful enough to make a real difference over time.

Pick a few, build momentum, and let the wins snowball.

Before you know it, you’ll save hundreds and build amazing money habits!

Share with me your favorite money-saving techniques that helped you overcome spending too much of your money.

Related Posts on Money Saving Techniques That Will Transform Your Year